«Growing Assets Collateral Management»

FORESTS RICH IN BIODIVERSITY

Severina, Damian, and Ezekeli are discussing with farip in Bahat’s natural forest how they can benefit from a natural forest. Damian says, “We understand the value of the natural forest very well. But we also need to solve our ongoing financial struggles with it. How can we turn our own natural forests into real money? At the moment, we’re forced to produce charcoal from it.” The discussion centers on how they can generate a steady income from their forests, which are rich in biodiversity. Could international biodiversity payments be a possible solution?

Severina, Damian, and Ezekeli are discussing with farip in Bahat’s natural forest how they can benefit from a natural forest. Damian says, “We understand the value of the natural forest very well. But we also need to solve our ongoing financial struggles with it. How can we turn our own natural forests into real money? At the moment, we’re forced to produce charcoal from it.” The discussion centers on how they can generate a steady income from their forests, which are rich in biodiversity. Could international biodiversity payments be a possible solution?

TCRD – TREE SECURED CREDIT FOR RURAL DEVELOPMENT

Dumila, Tanzania, 2024-09-14. Everyday reality for heavily indebted families: “The CRDB Bank is selling this house,” reads a sign in the village of Dumila. When debts cannot be repaid, the lender takes possession of the mortgaged land or house, leaving the family ruined. Are there alternatives? Yes—loans secured by trees instead of land! Over the past few years, initiative-driven farming families in Magunguli, together with farip, have developed and prototyped the tree-secured credit mechanism (TCRD, tree secured credit for rural development). These tree-secured loans for potato and bean cultivation, and for purchasing calves for fattening, have proven successful in practice.

Dumila, Tanzania, 2024-09-14. Everyday reality for heavily indebted families: “The CRDB Bank is selling this house,” reads a sign in the village of Dumila. When debts cannot be repaid, the lender takes possession of the mortgaged land or house, leaving the family ruined. Are there alternatives? Yes—loans secured by trees instead of land! Over the past few years, initiative-driven farming families in Magunguli, together with farip, have developed and prototyped the tree-secured credit mechanism (TCRD, tree secured credit for rural development). These tree-secured loans for potato and bean cultivation, and for purchasing calves for fattening, have proven successful in practice.

Bankers are quick to argue that trees are too weak as collateral. But Bahat, one of the initiators, counters: “A large tree is the strongest collateral you can imagine. If a farming family sees that they can’t fully repay the loan, they sell one or a few trees to the sawmill. The bank wouldn’t even notice that the family had a problem.” The farip delegation is now discussing the TCRD concept with the National Microfinance Bank in Dar es Salaam and is encountering great interest.

Bankers are quick to argue that trees are too weak as collateral. But Bahat, one of the initiators, counters: “A large tree is the strongest collateral you can imagine. If a farming family sees that they can’t fully repay the loan, they sell one or a few trees to the sawmill. The bank wouldn’t even notice that the family had a problem.” The farip delegation is now discussing the TCRD concept with the National Microfinance Bank in Dar es Salaam and is encountering great interest.

HAPPY FACES

Yohana Simon (left) and Yegela Mikembo at the cattle market in Ludewa.

Yohana Simon (left) and Yegela Mikembo at the cattle market in Ludewa.

Ludewa is a marketplace near Msowero, deep in the bush, at the edge of the savannah where the Maasai graze their livestock.

Together with farmers Josephine, Mensa and Minjigo, Yohana and Yegela bought calves six months ago with a GRACOMA loan. Now, after fattening them up, they’re able to sell the cows at a good price to the Maasai. This allows them to repay the loan, which they secured with trees on their plots.

This tree-secured credit mechanism is groundbreaking: In case of repayment difficulties, farmers don’t lose their land—only the trees. This is already the second credit cycle running as a TCRD prototype (tree secured credit for rural development) under farip’s supervision in Tanzania.

Could Trees Also Serve as Accident Insurance?

Continuous rain has left devastating conditions: roads are washed out; crops are swept away. The transport of harvests from growing areas to the cities is significantly hindered. This immediately impacts the supply to the point-of-sale in Dar es Salaam, as every single element in the economic network is inextricably linked. An accident with a transporter resulted in injuries, and the victims can barely afford hospital care.

Continuous rain has left devastating conditions: roads are washed out; crops are swept away. The transport of harvests from growing areas to the cities is significantly hindered. This immediately impacts the supply to the point-of-sale in Dar es Salaam, as every single element in the economic network is inextricably linked. An accident with a transporter resulted in injuries, and the victims can barely afford hospital care.

Could an “accident insurance” secured by growing trees be possible? This could lead to a turnaround in rural areas where illnesses and accidents with extraordinary costs repeatedly strain family solidarity to the breaking point. There is now widespread discussion in Msowero about initial experiments with such an insurance. This indicates that tree-secured loans could be used far beyond agricultural production.

Tree-secured loans have great potential

Msowero, 2024-06-01. The University of Dar es Salaam is now also interested in the tree-secured credit mechanism. Dr. Colman Msoka, the head of the Institute for Development Studies at the university, and his assistant Dr. Patrick Mlinga traveled to Msowero, to prepare their on-site research cycle on biodiversity and smallholder loans. Dr. Msoka commented: “Tree-secured loans have great potential to promote rural development.”

Msowero, 2024-06-01. The University of Dar es Salaam is now also interested in the tree-secured credit mechanism. Dr. Colman Msoka, the head of the Institute for Development Studies at the university, and his assistant Dr. Patrick Mlinga traveled to Msowero, to prepare their on-site research cycle on biodiversity and smallholder loans. Dr. Msoka commented: “Tree-secured loans have great potential to promote rural development.”

Magunguli, 2024-06-01. Ragpa Tweve serves as “Mtunza Misitu,” Forest Steward in the GRACOMA Credit Project. Interestingly, the ten farmers who have taken tree-secured loans want to compensate Ragpa with 1% of the loan amount for registering forest parcels and monitoring them. This marks a breakthrough in operating loans entrepreneurially. Reliable monitoring is crucial for commercial banks to develop an interest in loan security provided by trees.

Magunguli, 2024-06-01. Ragpa Tweve serves as “Mtunza Misitu,” Forest Steward in the GRACOMA Credit Project. Interestingly, the ten farmers who have taken tree-secured loans want to compensate Ragpa with 1% of the loan amount for registering forest parcels and monitoring them. This marks a breakthrough in operating loans entrepreneurially. Reliable monitoring is crucial for commercial banks to develop an interest in loan security provided by trees.

Magunguli, 2024-06-01. The innovative tree-secured credit mechanism in Tanzania is increasingly drawing interest, including from the Institute of Development Studies at the University of Dar es Salaam. Now, the institute’s director, Dr. Msoka, along with his assistant Dr. Mlinga, embarked on a week-long trip to Msowero and Magunguli in May. The trip aims to prepare for a research cycle, with a dozen students already enrolled at the Institute of Development Studies to explore topics such as biodiversity and tree-secured credits for rural development.

University Visits GRACOMA Field Laboratory

Dar es Salaam, 2024-04-25. The innovative tree-secured credit mechanism in Tanzania is increasingly drawing interest, including from the Institute of Development Studies at the University of Dar es Salaam.

Now, the institute’s director, Dr. Msoka, along with his assistant Dr. Mlinga, intends to embark on a week-long trip to Msowero and Magunguli at the beginning of May. The trip aims to prepare for a research cycle, with eight students already enrolled at the Institute of Development Studies to explore topics such as biodiversity and tree-secured credits for rural development.

The university’s interest stems from the master’s thesis of Rahel Guggenbühl at the University of St. Gallen. She traveled the country with farip and in 2023 examined the credit practices of local banks in Tanzania in relation to agricultural production. This collaboration with the Institute of Development Studies at the University of Dar es Salaam sparked interest in the topic of tree-secured credits (TCRD – Tree-secured Credit for Rural Development), which was jointly developed by the GRACOMA initiators with farip. The first two agricultural cycles have already been successfully tested as trial runs last year and early this year (see below).

Accompanied by Bahat and Elibariki, farip‘s local partners, the leadership of the Institute of Development Studies intends not only to speak with farmers about their experiences but also to engage with local authorities and banks.

For the GRACOMA initiators in the southern highlands, this is a significant recognition of their multi-year prototype development of the tree-secured credit mechanism. And for farip, it presents an ideal opportunity to provide the delegation with a professional cameraman to produce videos and photos for documentation. However, this incurs costs, even though the delegation will be staying with farming families and providing their own funds. farip requires at least 3,000 CHF for this purpose and appreciates any donations!

Empowering Tanzanian Farmers: FARIP’s Innovative Credit Experiment Unleashes Agricultural Potential

Zurich, 2024-01-23. Small-scale farmers in Tanzania could produce much more, but they lack access to operational loans. Banks are too distant, and they demand land as collateral. Yesterday in Zurich, Ueli Scheuermeier, the CEO of farip, explained a new credit mechanism. This mechanism was devised by Tanzanian farming families. The core idea is this: Farmers offer only the valuable trees on their plots as collateral for loans. Losing their land to the bank in the event of a crop failure is not an option for anyone.

Zurich, 2024-01-23. Small-scale farmers in Tanzania could produce much more, but they lack access to operational loans. Banks are too distant, and they demand land as collateral. Yesterday in Zurich, Ueli Scheuermeier, the CEO of farip, explained a new credit mechanism. This mechanism was devised by Tanzanian farming families. The core idea is this: Farmers offer only the valuable trees on their plots as collateral for loans. Losing their land to the bank in the event of a crop failure is not an option for anyone.

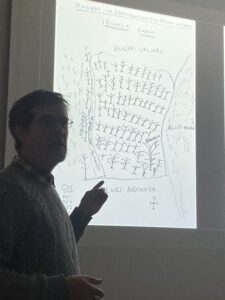

On a handwritten sheet, the owner and all neighbors confirm who owns the plot with the trees. Signed by the community leader, the sheet serves as collateral for the loan.

It’s an experiment. In a first attempt last year, farip acted as the bank, providing loans for seeds and payment of harvest helpers. The loans could be repaid from the harvest yield. Now, the experiment is gaining momentum, with the second round of trials set to begin soon.

Innovative Loan Mechanism: Trees as Collateral

Magunguli, November 2023. Tanzanian smallholder farming families could significantly increase their production if they had access to money at the right time for labor in the fields, for seeds, and fertilizers. However, money is always tight in the village. Loans? A master’s thesis from the University of St. Gallen has recently shown that there are no loans that smallholder farming families can afford. The interest rates are too high, and the risk of losing land and houses, which must be used as collateral, is too great. «But we are rich, just look at all the growing trees we have planted on our land. We just have to wait too long until we can sell the logs,» says Bahat Tweve. Why not offer their growing trees as collateral for loans?

Magunguli, November 2023. Tanzanian smallholder farming families could significantly increase their production if they had access to money at the right time for labor in the fields, for seeds, and fertilizers. However, money is always tight in the village. Loans? A master’s thesis from the University of St. Gallen has recently shown that there are no loans that smallholder farming families can afford. The interest rates are too high, and the risk of losing land and houses, which must be used as collateral, is too great. «But we are rich, just look at all the growing trees we have planted on our land. We just have to wait too long until we can sell the logs,» says Bahat Tweve. Why not offer their growing trees as collateral for loans?

Bahat developed «GRACOMA» from this idea. After careful consideration of how credit security could be organized with trees, farip financed a small-scale pilot project for the first time in 2023: 10 families registered their trees and received a loan from farip to plant beans and potatoes on 1/3 hectare each. Secured by the registration, farip, in the role of a «bank,» granted loans for potatoes worth 715 CHF each and beans worth 305 CHF each. It worked: The loans were repaid with interest after a successful harvest, and thanks to the marketing by the trading company TBM, which operates with the fair TSS trading mechanism, the families also earned decent money.

With the first successful attempt in the fields, a crucial milestone has now been achieved: On a village level, GRACOMA is practicable!

In the next agricultural cycle, starting in December, the initiators plan to: Extend new loans to the 10 existing farming families, but at twice the amount. Expand the recipient group from 10 to 100 smallholder farming families.

A FIRST GRACOMA TRIAL PASSES THE FIELD TEST

Magunguli, 2023-09-15. Ten farming families received a GRACOMA loan a few months ago. They used it to grow potatoes and beans on plots of land equivalent to about 2/5 of a hectare each (one acre). The harvest has been successfully collected and sold in Mabibo, a suburb of Dar es Salaam. The loans have been repaid with interest.

Magunguli, 2023-09-15. Ten farming families received a GRACOMA loan a few months ago. They used it to grow potatoes and beans on plots of land equivalent to about 2/5 of a hectare each (one acre). The harvest has been successfully collected and sold in Mabibo, a suburb of Dar es Salaam. The loans have been repaid with interest.

Thanks to the marketing efforts of the trading company TBM, which operates with the fair TSS trading system, the farmers have also made a good amount of money.

It wasn’t certain whether the GRACOMA credit system would work in practice. Until now, it was mainly theoretical discussions that were carefully considered by our project partners in Tanzania. With the success of this first trial in the fields, we have now achieved a significant milestone.

The trial worked in five steps:

- Elibariki Tweve, the GRACOMA agent chosen by farip, registered forest trees of the farming families on plots up to 1 hectare as a promise for loans.

- With this registration, farip gave loans for seeds, acting like a “bank”. For potatoes, each loan was about CHF 715, and for beans, about CHF 305.

- The GRACOMA agent on the ground made sure that the loans were used to grow potatoes and beans.

- After the harvest, the trading company TBM organized the sale of the potatoes and beans and paid the farming families a fair price in cash. The TSS trading system requires that all expenses and earnings are shown and explained clearly.

- This way, the farip loans could be paid back with interest (1% per month). And the producers made good money.

After the successful first round of loans, the farming families in Magunguli want to grow this GRACOMA credit system to produce more. farip will want to carefully study the detailed results of the trial before moving forward with a gradual expansion.

After the successful first round of loans, the farming families in Magunguli want to grow this GRACOMA credit system to produce more. farip will want to carefully study the detailed results of the trial before moving forward with a gradual expansion.

Then, this approach will be shown to local banks and sustainability funds in Switzerland that are interested in supporting this initiative.

GRACOMA KICK-OFF

Magunguli, summer 2023. Ten farming families in Magunguli are in the middle of an experiment: they use their growing forests as collateral for loans to expand their bean and potato production. TBM will organise the marketing. This represents the first realistic test run of their idea with GRowing Assets COllateral MAnagement (GRACOMA): using trees as collateral to enable investments in expanding food production.

TESTING THE SUITABILITY OF THE GRACOMA IDEA

Magunguli, spring 2023. Our local partner and trustee Elibariki Tweve visits a forest plot of farmers in Magunguli. He is about to register the trees growing there as loan collateral. Five farmers intend to use the loan to invest in seeds and work force. Each of them intends to cultivate one acre (just under half a hectare) of beans. With this small-scale test run, farip is testing the suitability of the GRACOMA idea, which was developed by the farmers themselves: GRACOMA (Growing Assets Collateral Management) is designed to enable farmers who previously had no access to credit to offer growing trees as collateral for loans. “If this experiment succeeds as the farmers envision, we will have made an important breakthrough for the independent financing of projects in rural areas,” Ueli Scheuermeier, CEO of farip, is pleased to say.

Magunguli, spring 2023. Our local partner and trustee Elibariki Tweve visits a forest plot of farmers in Magunguli. He is about to register the trees growing there as loan collateral. Five farmers intend to use the loan to invest in seeds and work force. Each of them intends to cultivate one acre (just under half a hectare) of beans. With this small-scale test run, farip is testing the suitability of the GRACOMA idea, which was developed by the farmers themselves: GRACOMA (Growing Assets Collateral Management) is designed to enable farmers who previously had no access to credit to offer growing trees as collateral for loans. “If this experiment succeeds as the farmers envision, we will have made an important breakthrough for the independent financing of projects in rural areas,” Ueli Scheuermeier, CEO of farip, is pleased to say.

THE FOREST RANGER WITH HIS TREE NURSERY

Magunguli, 2022-06-09. Ragpa lives with his young family in the remote village of Magunguli on the edge of Udizungwa National Park. Almost every family there also grows their own Pinus and Eucalyptus trees on their own land. Ragpa started a tree nursery in 2018 with loans from farip. He is now growing Pinus and Eucalyptus, but also indigenous trees such as the Mikusu.

Magunguli, 2022-06-09. Ragpa lives with his young family in the remote village of Magunguli on the edge of Udizungwa National Park. Almost every family there also grows their own Pinus and Eucalyptus trees on their own land. Ragpa started a tree nursery in 2018 with loans from farip. He is now growing Pinus and Eucalyptus, but also indigenous trees such as the Mikusu.

One day, the trees will bring in good money for the wood – but the farmers have to wait 15-20 years. To bridge the gap, they came up with a great idea: using their still growing trees as “collateral” – security for much-needed loans. Understandably, lenders want to be sure the trees are protected until the credit is repaid. The association of tree planters in Magunguli therefore set up GRACOMA «Growing Assets Collateral Management ». The organisation documents tree growth and reports to the lenders. The Swiss-based Ithaka Institute also got interested. As a CO2-certifier, they demand strict registration and careful checking.

HISTORY OF THE PROJECT

2019-12-09. While the tree nursery makes a lot of sense on its own, the project has to be seen in the context of the ideas around “GRACOMA”. A loose group of 60 farming families, the “Mgololo Tree Planter Association”, has been exploring forestry loan collateral for years.

The idea is to be able to offer their own growing trees as security for credits. It quickly became clear that there is huge economic and also ecological potential in planted trees. Active implementation, however, remained a challenge.

The central requirement is that lenders who accept trees as collateral have to be able to prove over many years that the trees are still there, being nurtured, and owned by the people who took the loans.

The farmers soon realised that this would require an independent organization for supervision, monitoring and control of the forest plots on behalf of the lenders. This led to the idea of setting up a company called Growing Assets Collateral Management (GRACOMA). This company would train people from the village to inspect specially registered forest plots, and also empower the farmers to make the most of their forests in a sustainable way. They would then call such forest wardens “Watunza Misitu” (singular Mtunza misitu).

To help with the early phase of this business idea, farip volunteered to temporarily simulate a “GRACOMA” company and cover the risk. This allowed Ragpa to launch his tree nursery and experiment with forest registration as the first regularly paid Mtunza Misitu. He is starting with his own forest plots to secure his farip loan. Other initiators have also offered to secure future farip loans with trees for their own projects.

HOW CAN GRACOMA EARN INCOME?

The farmers do not have spare cash available. The model is therefore that they allocate trees per hectare of registered forest to GRACOMA every year. When the trees are harvested in a few years, they would earn GRACOMA’s credit sum plus a profit. But it takes up to 20 years for GRACOMA to get any money at all … so GRACOMA itself would have to get long-term loans, which in turn would also be covered by the signed-over trees, and so on. It is complex.

Which financial institution would actually be willing to give short-term production loans on such long-term – but interestingly, rapidly more valueable – collateral? For example, to invest in vehicles, pumps, seeds, mills, irrigation equipment, cows, fruit plants, metal silos, etc.?

farip is strongly challenged here to follow the thought processes and considerations of the tree planters of Mgololo. When we asked how they could make it simpler, the now deceased old Kandidussi replied: “If it is simple, it cannot work. It is complex, many things have to interlock”. An important lesson learned for farip. The whole GRACOMA experiment still needs to be thought through in detail. It turns out that it is better to make progress with concrete small implementations.

The basic idea of the farmers in the Mgololo area is captivating! From farip‘s point of view, this is a highly interesting environment because it has potential leverage effects for financing many projects in rural areas. And most importantly, it also allows poor people to use their labour and attention to nature (e.g. forest fire protection) as their own resource to access much-needed capital for their investments. They can put well-supervised trees on the line as assets. They thus avoid being mere aid recipients, and become real business partners. This is the main idea driving the project.

Detailed elaboration and testing of the mechanisms takes a lot of time. The current bottleneck is that farming families do not yet see the point of registering a forest plot with GRACOMA without getting a suitable loan for it within a short time. Ragpa, on the other hand, has already demonstrated the feasibility. He got a loan from farip for a motorbike, using his own forest plots as security.

How can these tree planters from Mgololo convince credit institutions of the viability of this long-term model? And how can the main problem of credit institutions, namely the unacceptably high transaction costs for small loans in these remote areas, be solved? farip is looking to simulate a credit institution with its own loans. This gives people a chance to show that it works – or at least to be able to make mistakes until they see how it can work.

What will happen to Ragpa and his tree nursery? Action can be taken quickly. First and foremost, Ragpa needs production orders for the tree nursery. farip, acting as GRACOMA, has taken on a sales guarantee for seedlings of indigenous trees, for the tree nursery to get into production.